At present, this regulation is being applied at 27 international customs checkpoints across the country, where an automated tax administration system has been installed in the Asycuda. Click here for international, local and custom checkpoints.

Customs declaration procedures for importing goods at international customs checkpoints using the customs clearance

There are 5 steps for the customs declaration in importing goods and transit goods through borders:

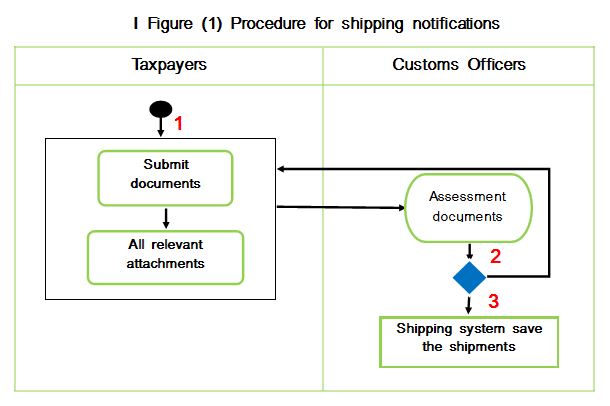

1. Procedures for notifying shipping documents;

2. Procedures for filling in customs clearance;

3. The procedure for receiving customs clearance and inspecting by the customs authorities;

4. Procedures for payment of taxes and other obligations;

5. Procedures for inspecting the release of goods from customs checkpoints.

Step 1: Shipping documents and goods to notify the customs authorities include:

1. Documents shipping goods;

2. Invoice;

3. Packing list (if any);

4. Certificate of origin and goods (if any);

5. A copy of the original customs declaration as for export country (if any).

Step 2: After submitting the documents to the authorities at the checkpoint, if the documents are incomplete, the authorities will not accept the documents and advise to complete the documents.

Step 3: If the documents are complete, the customs officer will enter the tracking number on the consignment note to allow the requesters to be able to leave their goods in the warehouse.

Step 4: Obtain a license to bring the goods to the warehouse.

Note: After arriving goods at the border customs, the taxpayer must be directly responsible for bringing the shipping documents related to the goods to the customs authorities to inspect and enter the tracking number of the goods. After that, goods can be transferred to the warehouse or any places which were assign by customs offices in order to wait for customs declaration. Shipment information must be submitted to the inspection and management unit for goods at the border customs checkpoint for management in accordance with the regulations.

Or report in the form prescribed by the customs authorities. The notification of shipment documents upon arrival of goods at the border checkpoints must be completed within twenty-four hours.

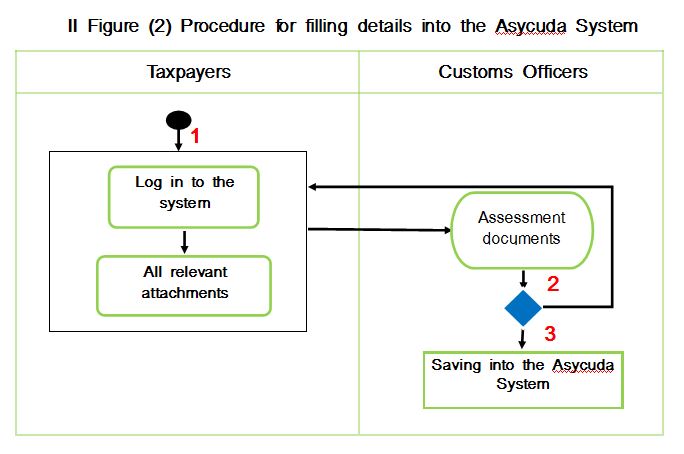

The customs declaration can include information on the import of goods into the system as a precaution before the goods arrive at the checkpoint or notify when the goods at the border checkpoints as following steps:

Step 1: The documents:

1. Documents of shipment goods;

2. Invoice;

3. Packing list (if any);

4. Certificate of Origin (if any);

5. Import license of the relevant government agency;

6. Other relevant documents.

Step 2: There are two cases:

1. Customs declaration before goods arrive at the border customs checkpoint:

The taxpayer fills in the details of the customs declaration with the supporting documents as indicated in Figure (1), enters the system and prints the customs declaration in detail, sign, stamp or sign the electronic form recognized by the tax authorities and attach the relevant documents to the customs authorities.

2. Customs declaration after goods have arrived to the border checkpoints:

The taxpayer fills in the details of the customs declaration with the supporting documents as indicated in Figure (1) into the electronic system and print the customs declaration in detail out of the system, as well as sign, stamp or electronically sign the form recognized by the tax authorities,

Note: The taxpayer can enter the declaration information into the system within seven working days before the goods arrive the border checkpoints.

Step 3: Authentication

III. Detailed customs declaration and inspection of the customs authorities

After receiving the documents, the customs authorities must request the information according to the tax declaration number as detailed in the system to check and compare with the actual documents. If complete, the system will conduct a detailed analysis of tax risk management in four levels according to tax regulations.

IV. Payment of taxes and other obligations

After going through the tax formalities and certifying the results of the declaration in the system, the taxpayer must pay the taxes and other obligations to the treasury or bank.

V. Checking for releasing goods from the customs checkpoint.

The taxpayer must bring the complete documents to the customs officer at the checkpoint to check the documents are complete then allows to release the goods from the border customs immediately and keep 2 copies of the customs declaration documents.

For further information please consult with the Department of Customs, Ministry of Finance at http://www.customs.gov.la

Please share your feedback below and help us improve our content.