(Unofficial translation)

LAO PEOPLE’S DEMOCRATIC REPUBLIC

PEACE INDEPENDENCE DEMOCRACY UNITY PROSPERITY

Department of Tax No.1128/DT

Vientiane Capital, date 24 April 2020

Extended Notification

On the calculation of income tax

To: Individuals, Entrepreneurs, Legal Entities, Domestic and Foreign Investors in the Nationwide

Subject: Implementation of tax obligations under the Agreement on Policies and Measures to Reduce the Impact of the COVID-19 Outbreak.

- Pursuant to the Law on Tax Administration (Amended), No. 66/NA, dated 17 June 2019;

- Pursuant to the Prime Minister's Decision No. 06/PM, dated 29 March 2020 on the measures to reduce the impact of the COVID-19 outbreak on the Lao economy;

- Pursuant to the Prime Minister's Decision No. 31/PM, dated 02 April 2020 on the policies and measures to reduce the impact of the COVID-19 outbreak on the Lao economy;

- Pursuant to the Notification of the Minister of Finance No. 1027/MOF, dated 10 April 2020;

- Pursuant to the Decision of the Minister of Finance No.2834/MOF, dated 22 August 2017 on the organization and operation of the Department of Tax.

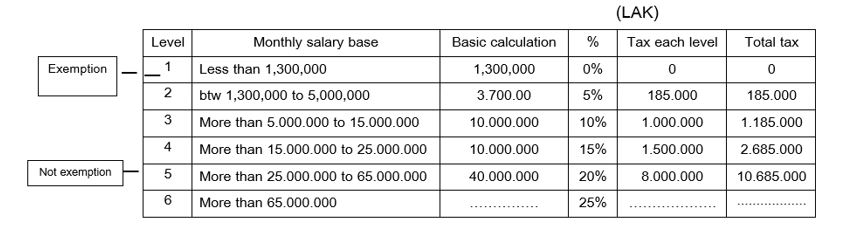

The Department of Tax would like to inform you that: in accordance with the decision of the Prime Minister, No.31/PM, dated 02 April 2020 in implementing the exemption of income tax for all public and private workers who earns less than LAK 5 million for 3 months (April, May and June), as details below:

In case of income less than LAK 5 million which is divided into 2 calculation.

- Below LAK 1,300,000 is 0% income tax (exemption to the law)

- Between LAK 1,300,000 to 5,000,000 at the rate of 5% (except according to the decision No.31/PM)

- Employees who earn more than LAK 5 million that will be deducted by LAK 5 million first then calculate the multiplier starting from the rate of 10% or more according to the income tax calculation schedule specified in Article 39 of the Income Tax Law No. 67/NA, dated 18 June 2019 as details below:

The notification schedule of tax payment as details following:

• Income tax of April 2020 should be notified and paid no later than 20 May 2020;

• Income tax of May 2020 should be notified and paid no later than 20 June 2020;

• Income tax of June 2020 should be notified and paid no later than 20 July 2020.

Therefore, we would like to inform for your reference and strictly follow this notice.

Director General

Phouthanouphet Saysomboun

| # | Title | Download |

|---|---|---|

| 1 | Notification of income tax, No 1128/TD, dated 24 April 2020 |  PDF PDF |

| 2 | ແຈ້ງການ ກ່ຽວກັບການຄິດໄລ່ອາກອນລາຍໄດ້ຈາກເງິນເດືອນ, ເລກທີ 1128/ກສອ, ລົງວັນທີ 24 ເມສາ 2020. |  PDF PDF |

Please share your feedback below and help us improve our content.