This regulation is currently used at 27 international customs checkpoints in Lao PDR. Click here for the list of the international checkpoint

Asycuda procedures for declaring export duties at international customs checkpoints

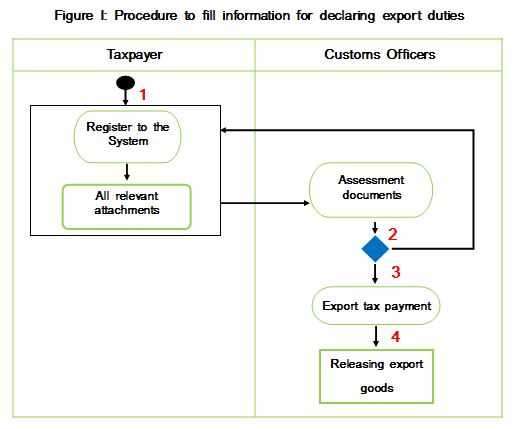

There are 4 steps to declare export duties and transit goods at the customs checkpoints:

Filling details of customs declaration;

Considering customs declaration and inspecting by the customs authorities;

Duties payment and other obligations;

Checking the release of goods and move from the customs borders.

The customs declaration system can be notified online before or after arriving goods at the checkpoint borders as the following steps:

Step 1: Fill in the customs declaration system

Shipping documents;

Purchase order;

Packing lists (if any);

Certificate of Origin (if any);

Export license of the relevant government agency;

Other relevant documents.

Step 2: There are 2 cases for considering customs declaration and inspecting by the customs authorities:

1. The customs declaration before arriving goods at the checkpoint borders

The taxpayers must log in into the customs declaration system then fill in the details together with the supporting documents as indicated in Figure I. Once the declaration is completed, the taxpayer must print the duty declare form with a signature and seal or an e-signature which is accepted by the Customs Authorities. Finally, attachment the declare form with relevant documents to submit to the Customs Authorities.

2. The customs declaration after arriving goods at the checkpoint borders:

The taxpayers must log in into the customs declaration system then fill in the details together with the supporting documents as indicated in Figure I. Once the declaration is completed, the taxpayer must print the duty declare form with a signature and seal or an e-signature which is accepted by the Customs Authorities. Finally, attachment the declare form with relevant documents to submit to the Customs Authorities for inspection and verify as following the customs policies.

Note: The taxpayer can enter the declaration information into the system within seven working days before the goods export from the customs checkpoints.

Step 3: Duties payment and other obligations

After going through the customs clearance procedure and confirming the result of the declaration into the system, Click here to check the type of goods that require export duties.

Step 4. Checking the release of goods before moving from the customs checkpoints.

The taxpayer must bring the complete documents to the customs officers at the checkpoint to check the documents are complete and then allow the goods to be released from the borders. Finally, the taxpayers must keep 2 copy sets of the customs declaration for their reference.

More information can be found here and the Customs Department, Ministry of Finance http://www.customs.gov.la

| # | Title | Description | Issued By | File |

|---|---|---|---|---|

| 1 | ACDD (Customs Declaration) | Customs Declaration | Ministry of Finance |

| # | Name | Description | Measure Type | Agency | Comments | Legal Document | Validity To | Measure Class |

|---|---|---|---|---|---|---|---|---|

| 1 | Export charge requirement - Natural resources | Exporting natural resources shall be charged as specified in President's Edict no. 001/PSD | Duty/Tax Payable | Ministry of Finance | For state revenue collection. | Presidential Ordinance on Royalty Rate of Natural Resources no. 001/POL, dated 15 December 2015 | 9999-12-31 | Good |

| # | Process name | Process short name | Activity |

|---|

Please share your feedback below and help us improve our content.