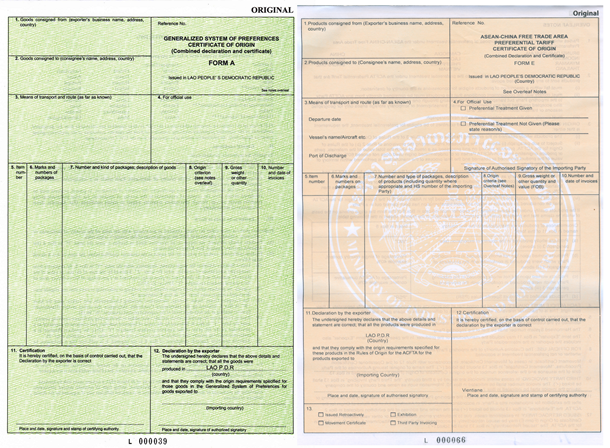

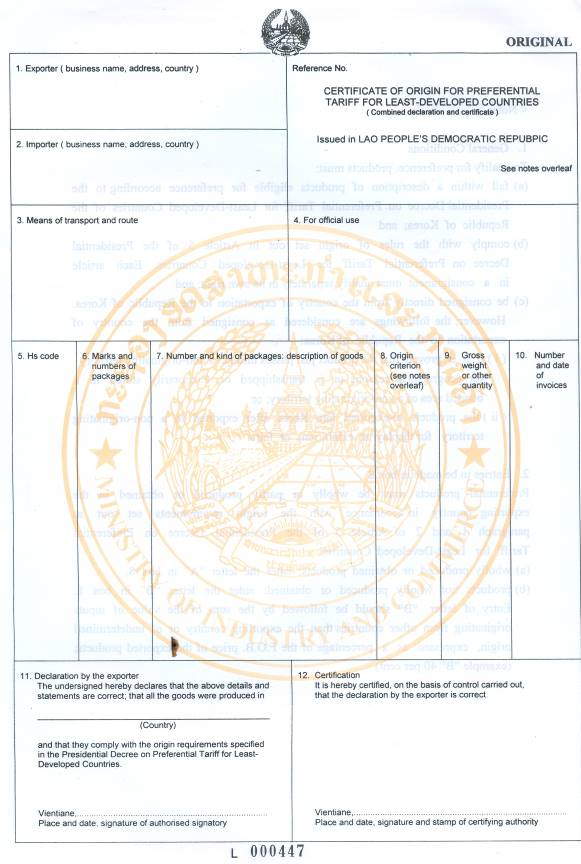

CO is not a required document for permission to export. CO used to reduce or exempt import tariff which helps exporters to save cost instead of paying full customs in ordinary rate (MFN). If the import country does not require such a document, the exporter can process on export procedure without requesting for CO. If exporter requires CO, they shall complete supporting documents in accordance with CO regulations following:

For manually CO issuance:

1.Entrepreneur shall submit supporting documents following to Issuing CO Authority Office:

- Request letter from company

- Copy of valid Confirmation of Product Eligibility(CPE)

- CO with data filled

- Invoice and packing list

- detailed Customs Declaration

- Copy of transport bill

2. Accuracy checking/notify company/approve form

3.Signed and sealed on CO

4. Fees payment

5. Bring along the receipt to get CO

For e-CO issuance:

1. Entrepreneur shall fill data in CO form, then upload the supporting documents following as PDF version via www.ecolao.gov.la

- Request letter from company

- Copy of valid Confirmation of Product Eligibility(CPE) in database

- CO form (in database)

- Invoice and packing list

- Detailed Customs Declaration

- Copy of transport bill

2. Accuracy checking/notify company/approve and print form

3. Signed and sealed on CO

4. Fees payment

5. Bring along the receipt to get CO

For manually CO takes 04 hours and time expected in 2019 will be 01 hour per set. For e-CO takes 02 hours and time expected in 2019 will be 30 minutes per set. Moreover, CO staffs are able to issue CO manual approximately 20 sets per day and issue e-CO approximately 30 sets per day. Currently, the Ministry of Industry and Commerce is testing for e-CO by printing CO with the signature and seal of the company on CO form. Entrepreneur can come to pay fee and get CO without printing.

Please share your feedback below and help us improve our content.