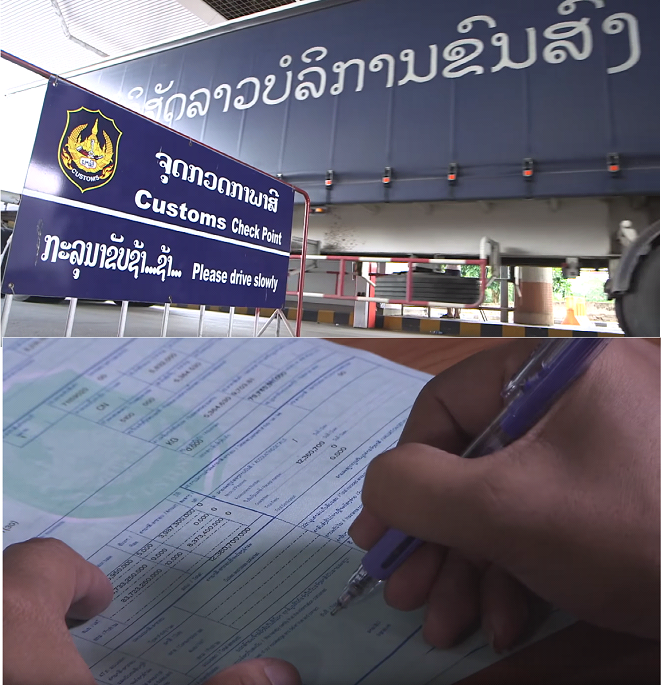

Duty and value-added tax incentives define the list of permanent and temporary import goods in the master list for the utilization in the productions and investment activities of the enterprise, which is in investment promotion business activities in accordance with Law on Investment Promotion, and the investment business activities from an agreement signed with the Government. Conditions incentives for investors investing in the Lao PDR as follows:

1. Shall be Entities eligible

2. Enterprise is in investment promotion business activities in accordance with Law on Investment Promotion

3. Investment in the business sector to be granted incentives shall have a value of at least 1.2 billion Kip; or employed at least 30 Lao skilled labor or using fifty or more Lao national employees with the employment contract of at least 1 year.

4. Business operations shall be regular and subject to clearance of all duties and taxes as required by laws and regulations and shall attach an annual tax payment certificate.

Documents to request duty and value-added tax incentives

1. Application form for duty and value-added tax incentives for the master list of a company;

2. Letter of authorization, certified and approved by the president or director-general of the enterprise.

3. A brief report of business operation status including the content of actual import in recent year, labor, etc.;

4.Draft of annual import plan (standard forms/tables from Planning and Investor sector) and soft file;

5. Copy of investment license (if applicable), enterprise registration certificate, business operating licenses from the concerned sector, annual tax payment certificate in a recent year, an agreement signed with the Government (in case of concession investment project) and license on construction (in case of a new building)

6. Copy of import plan in recent year;

7. Copy of annual plan of enterprise, certified by Industry and Commerce sector (In case of enterprise or factory in production)

In addition, projects from an agreement signed with the Government and a resolution approved by National Assembly with investment value over US$ 1 billion, the approval of import plan shall be signed by Minister of Planning and Investment.

For more information, please contact:

Ministry of Planning and Investment

Permanent Secretary Office Tel:+856 21 217010

Investment Promotion Department (One Stop Service)

Tel: +856 21 217012

Fax: +856 21 215491

Email: [email protected]

Click here to see more details of this instruction

Please share your feedback below and help us improve our content.