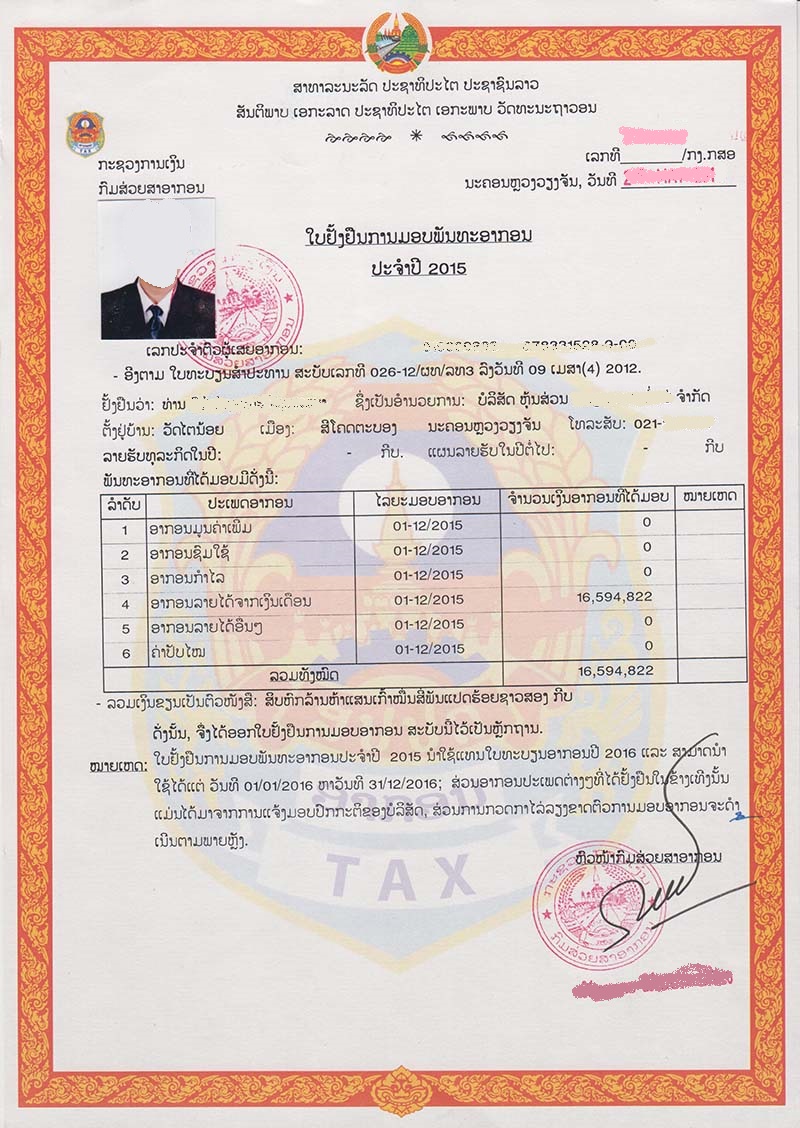

Pursuant to Rules of Tax Payment Certificate No. 1025/MoF, dated 03 April 2019, any individual, legal entity and organization indenting to undertake the tax payment certificate must have following document required:

1. For a new business operator

After enterprise registration and taxpayer identification number from industry and commerce sector, all business operator must submit an application (defined by tax sector) for the tax payment certificate to tax sector following document required:

- An application for the tax payment certificate

- Copy of enterprise registration certificate

- Annual business turnover and tax payment plans

2. For a new business operator

All business operator must submit the report of final closed accounts in the fiscal year and concerned documents to tax authorities at tax office no later than March 31 of the following year, document required below:

- Set of an application: an application, report of outcome in the fiscal year, summary of annual tax payment, annual business turnover and tax payment plans of the following year.

- The report of final closed accounts in the fiscal year.

Source: http://vangtatmining.com

3. For a business operator with lump sum tax

All business operator with lump sum tax must submit an application for the tax payment certificate no later than January 31 of the following year, document required below:

- An application

- Lump sum tax payment contract

- Document concerning the tax hand-over certificates

For income earner in the Lao PDR is able to obtain the tax payment certificate on a monthly, quarterly, semi-annual or annual basis following the period of project.

In addition, the tax payment certificate will be issued within 05 official days from the date of receiving the accurate document.

For more information, please contact:

Ministry of Finance

Tax Department

Phone: 021-217025, 021-242688

Website: http://taxservice.mof.gov.la/websquare/websquare.do

Please share your feedback below and help us improve our content.