This procedure is generally applicable for all types of goods exported from Laos under the EX1 Customs regime.

However, different types of goods may require different supporting documents to be presented to Customs together with a declaration. Please check this website or with the relevant authorities if you are in doubt as to whether a specific permit or license is required.

At present, this regulation is currently applied at every border post, except for 11 Lao International border check points, such as the Thanaleng border post, Namphao International border check point, Deansavanh International border check point, Botean International border check point, Houayxay International border check points, Second Friendship Bridge border check point, Vangtao International border check point, Nam Xouy Int where the International border check point, Nam Leuang Friendship bridge border check point, Third Friendship border check points, Wattay International border check point, which the ASYCUDA is applied. Click here to view regulation on custom payment at those 11 posts.

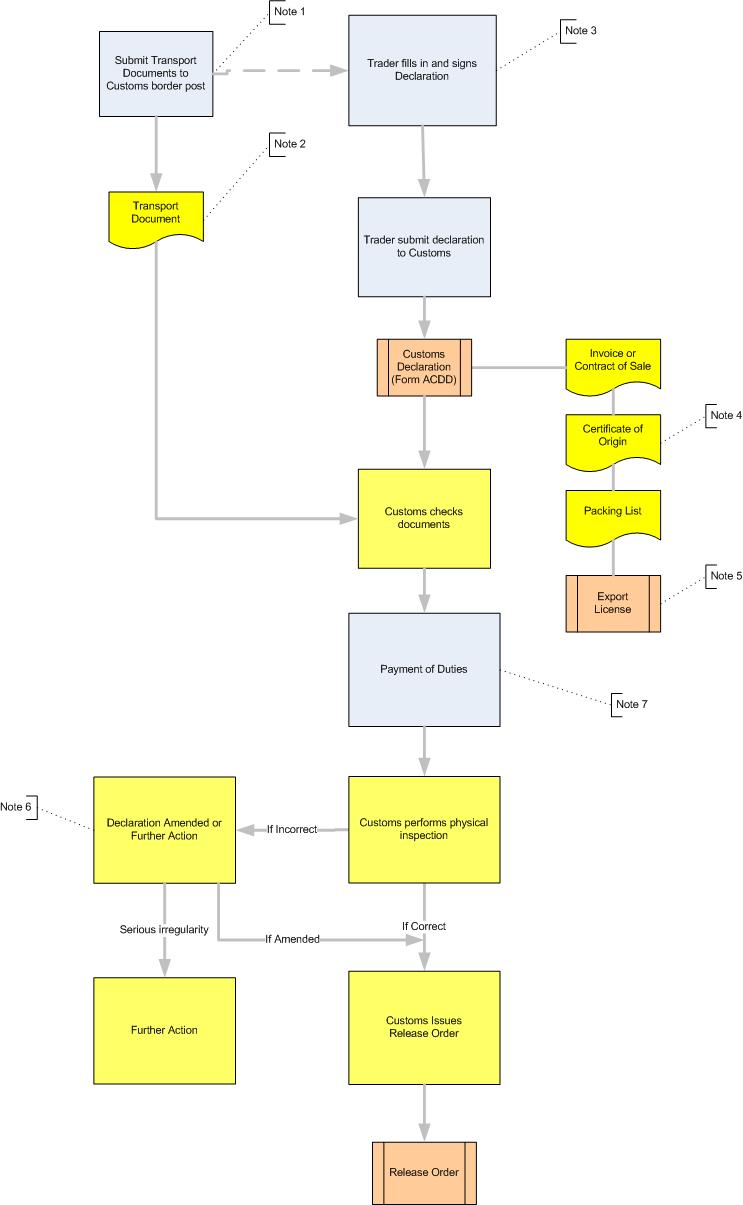

Note 1

Transport documents must be submitted to Customs within 24 hours of the arrival of the goods at the border.

Note 2

Transport documents are the commercial documents that describe the contents of the craft or vehicle that transports the goods and that arrives at the border post. These could be a manifest (in the case of air cargo), a transport notice, a load or packing list or a copy of the export declaration in the case of road vehicles.

Note 3

A declaration must be submitted within 15 days from the date of lodgement of the transport documents.

A declaration must be submitted using Form ACDD. A duly authorized ACDD form can be collected from the Customs office at the border post.

Note 4

A Certifcate of Origin for exports for all countries with which Lao PDR has a preferential tariff (e.g. ASEAN) may be obtained from the Certificate of Origin Division of the Department of Import and Export, Ministry of Industry and Commerce.

The Lao National Chamber of Commerce and Industry is responsible for issuing Certificates of Origin for goods to be exported to all other countries.

Note 5

An Export License is issued by the Department of Import and Export of the Ministry of Industry and Commerce for those goods that are subject to licensing requirement. Click here to view the procedure for obtaining an Import License.

Note 6

If an irregularity results in an amendment of the declaration the trader may proceed with the clearance process. If an irregularity is deemed to constitute a serious offence, Customs may decide to take the appropriate enforcement action.

Note 7

Most exports do not attract Customs duties. However, on some commodities Customs Duty is payable. Please click here to find out which commodities are subject to export duty. In addition some other taxes may apply. Currently payment of duties at 11 International border posts may be made at the bank office at the border post or in cash. The bank will issue a receipt which the trader will present to Customs before clearance is issued.

| # | Title | Description | Issued By | File |

|---|---|---|---|---|

| 1 | ACDD (Customs Declaration) | Customs Declaration | Ministry of Finance |

| # | Name | Description | Measure Type | Agency | Comments | Legal Document | Validity To | Measure Class |

|---|

| # | Process name | Process short name | Activity |

|---|

Please share your feedback below and help us improve our content.